trading-signals-mcp

v1.0.13

Published

Model Context Protocol for technical analysis ability

Maintainers

Keywords

Readme

🔥 Trading Signals MCP Server

claude_desktop_config.json

{

"mcpServers": {

"trading-signals-mcp": {

"command": "npx",

"args": ["-y", "trading-signals-mcp"]

}

}

}

Overview

Trading Signals MCP Server is a comprehensive technical analysis service designed to provide real-time cryptocurrency trading signals and market insights through the Binance exchange. It delivers multi-timeframe analysis, advanced technical indicators, order book data, and historical candle patterns to support informed trading decisions. The server utilizes the Model Context Protocol (MCP) framework to ensure structured and efficient data delivery.

Key Functionalities:

- Multi-timeframe technical analysis (1-minute to 1-hour candles)

- Comprehensive technical indicators (RSI, MACD, Bollinger Bands, Fibonacci levels, and more)

- Real-time order book analysis and liquidity tracking

- Volume analysis with institutional activity detection

- Historical candle data with volatility metrics

- Trend slope analysis for precise entry/exit timing

- Support for multiple trading strategies (scalping, day trading, swing trading)

Features

- [x] Long-Term Signals (1h): 48-hour analysis with comprehensive technical indicators and Fibonacci levels

- [x] Short-Term Signals (15m): 36-hour high-frequency analysis for rapid market movements

- [x] Swing-Term Signals (30m): 48-hour medium-term trend analysis

- [x] Micro-Term Signals (1m): Ultra-fast 1-hour analysis for precision timing

- [x] Volume Data Analysis: Pivot points, volume spikes, and institutional activity detection

- [x] Slope Data Analysis: Minute-by-minute trend slope for immediate momentum shifts

- [x] Order Book Analysis: Real-time liquidity zones and whale order detection

- [x] Historical Candle Data: OHLCV data with volatility metrics (1m, 15m, 30m, 1h)

- [x] Binance API Integration: Direct connection to Binance exchange for live market data

- [x] MCP Framework: Structured data delivery using Model Context Protocol

Requirements

- Node.js (v18 or later) - Required for NPX execution

Installation

Recommended: Using NPX (No Installation Required)

The easiest way to use Trading Signals MCP Server is with NPX. This method doesn't require cloning the repository or installing dependencies.

Add this MCP server to Claude Desktop by editing the configuration file:

- macOS:

~/Library/Application Support/Claude/claude_desktop_config.json - Windows:

%APPDATA%\Claude\claude_desktop_config.json - Linux:

~/.config/Claude/claude_desktop_config.json

Add the following configuration:

{

"mcpServers": {

"trading-signals-mcp": {

"command": "npx",

"args": ["-y", "trading-signals-mcp"]

}

}

}Restart Claude Desktop for the changes to take effect.

Alternative: Local Installation

If you prefer to run a local copy or need to modify the code:

git clone https://github.com/tripolskypetr/trading-signals-mcp.git

cd trading-signals-mcp

npm install

npm run buildThen configure Claude Desktop with the local path:

{

"mcpServers": {

"trading-signals-mcp": {

"command": "node",

"args": [

"/path/to/trading-signals-mcp/build/index.mjs"

]

}

}

}Make sure to replace /path/to/trading-signals-mcp with the actual path to your cloned repository.

Configuration

No additional configuration is required. The server uses Binance's public API endpoints to fetch market data.

Usage (For Connecting MCP HOST other than Claude)

Start the Server

To start the MCP server, run:

npm startAvailable Tools

Technical Analysis Tools

Long-Term Signals -

fetchLongTermSignals{ "symbol": "BTCUSDT" }- Timeframe: 1-hour candles, 48-hour lookback

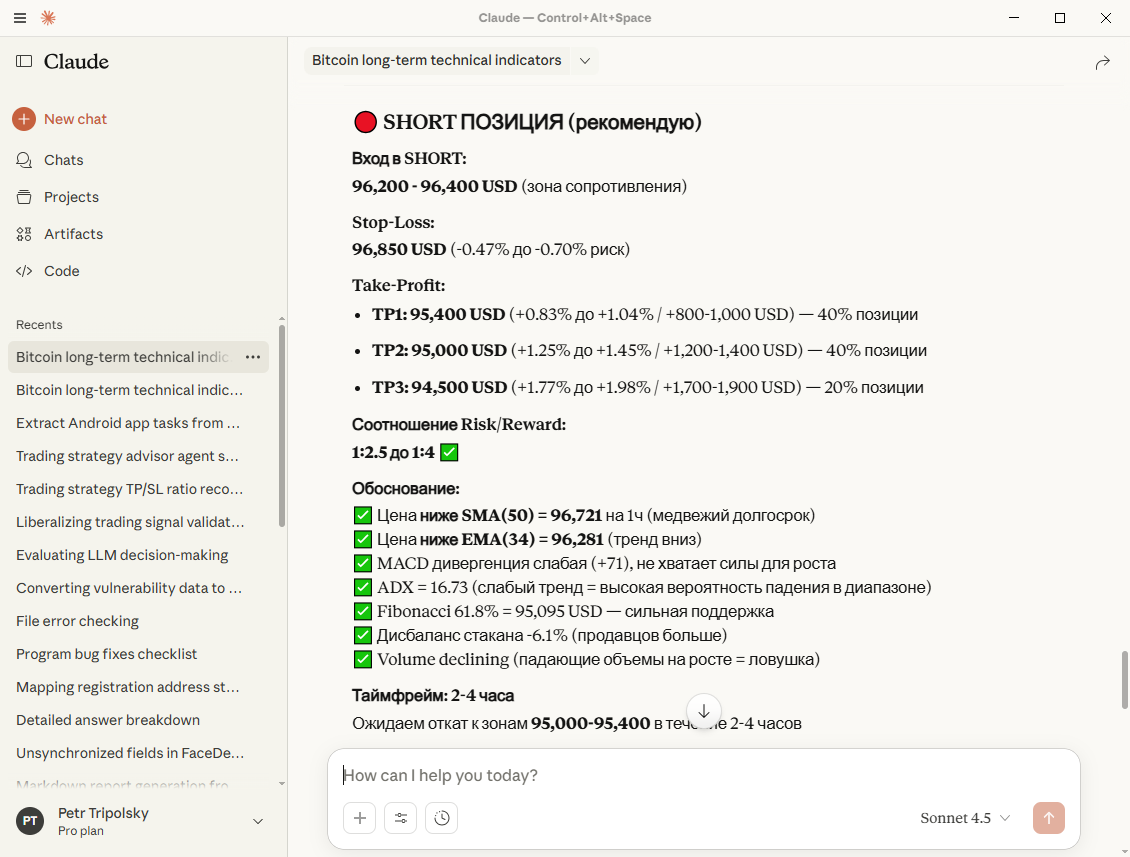

- Indicators: RSI(14), Stochastic RSI(14), MACD(12,26,9), Bollinger Bands(20,2), ATR(14,20), SMA(50), EMA(20,34), DEMA(21), WMA(20), Momentum(10), Stochastic(14,3,3), CCI(20), ADX(14)

- Features: Fibonacci retracement/extension levels, support/resistance detection, candle patterns, volume trends, 15 recent candles

- Use Case: Position timing over extended periods, confirming directional bias

Short-Term Signals -

fetchShortTermSignals{ "symbol": "BTCUSDT" }- Timeframe: 15-minute candles, 36-hour lookback

- Indicators: RSI(9), Stochastic RSI(9), MACD(8,21,5), Bollinger Bands(10,2), ATR(9), SMA(50), EMA(8,21), DEMA(21), WMA(20), Momentum(8), Stochastic(5,3,3), CCI(14), ADX(14), ROC(3)

- Features: Fibonacci levels (288 candles), support/resistance, volume trend analysis

- Use Case: Detecting rapid market movements, high-frequency trading signals

Swing-Term Signals -

fetchSwingTermSignals{ "symbol": "BTCUSDT" }- Timeframe: 30-minute candles, 48-hour lookback

- Indicators: RSI(14), Stochastic RSI(14), MACD(12,26,9), Bollinger Bands(20,2), ATR(14), SMA(20), EMA(13,34), DEMA(21), WMA(20), Momentum(8), Stochastic(14,3,3), CCI(20), ADX(14)

- Features: Comprehensive volatility analysis, Fibonacci levels, support/resistance

- Use Case: Medium-term trend analysis, bridging signals between timeframes

Micro-Term Signals -

fetchMicroTermSignals{ "symbol": "BTCUSDT" }- Timeframe: 1-minute candles, 1-hour lookback

- Indicators: RSI(9,14), Stochastic RSI(9,14), MACD(8,21,5), Bollinger Bands(8,2), Stochastic(3,5), ADX(9), ATR(5,9), CCI(9), Momentum(5,10), EMA(3,8,13,21), SMA(8), DEMA(8), WMA(5)

- Features: Volume analysis, price changes (1m/3m/5m), volatility, Bollinger position, squeeze momentum, pressure index

- Use Case: Ultra-precise timing, rapid reversals detection, scalping

Volume Data Analysis -

fetchVolumeData{ "symbol": "BTCUSDT" }- Timeframe: 1-hour candles, 220-hour data for SMA(200)

- Features: Pivot points (S1/S2/S3, R1/R2/R3), volume spikes (1.5x+), SMA(20,50,200), EMA(12,26,50), DEMA(21), WMA(20), RSI(14), Stochastic RSI(14), Bollinger Bands(20,2), ATR(14), ADX(14), CCI(20), Momentum(10)

- Use Case: Volume validation, liquidity zones, institutional activity detection

Slope Data Analysis -

fetchSlopeData{ "symbol": "BTCUSDT" }- Timeframe: 1-minute candles, 2-hour lookback (120 candles)

- Indicators: SMA(15), EMA(15), Price Slope (USD/minute), Momentum(10), VWAP, VMA(15), Volume Momentum(10), Price-Volume Strength

- Features: Detailed price/volume arrays with timestamps

- Use Case: Precise entry/exit timing, immediate trend changes, micro-movements

Order Book Data -

fetchBookData{ "symbol": "BTCUSDT" }- Features: Best Bid/Ask, Mid Price, Spread, Depth Imbalance, Top 20 order levels (bids/asks), percentage distribution

- Use Case: Liquidity gaps, whale orders, market maker behavior, breakout/breakdown levels

Historical Candle Tools

Hour Candle History -

fetchHourCandleHistory{ "symbol": "BTCUSDT" }- Data: Last 6 hourly candles with OHLCV, volatility %, body size %, candle type

Fifteen-Minute Candle History -

fetchFifteenMinuteCandleHistory{ "symbol": "BTCUSDT" }- Data: Last 8 15-minute candles with HIGH-VOLATILITY flagging (>1.5x average)

Thirty-Minute Candle History -

fetchThirtyMinuteCandleHistory{ "symbol": "BTCUSDT" }- Data: Last 6 30-minute candles with volatility metrics

One-Minute Candle History -

fetchOneMinuteCandleHistory{ "symbol": "BTCUSDT" }- Data: Last 15 1-minute candles for ultra-granular analysis

Model Context Protocol (MCP)

The Model Context Protocol (MCP) is an open standard designed to enhance the way applications interact with AI models and data sources. MCP establishes structured context that improves the efficiency of data delivery and analysis.

Benefits of MCP:

- Standardization: Defines a unified approach for application interactions

- Efficiency: Reduces computational overhead and improves data delivery speed

- Interoperability: Supports integration across multiple platforms and AI systems

- Structured Data: Ensures consistent formatting for technical analysis data

Error Handling

When a tool call fails, the server returns an error message with details. Common error scenarios include:

- Invalid trading symbol

- Binance API authentication errors

- Rate limiting restrictions

- Network connectivity issues

- Insufficient data for calculations

License

This project is open-source under the MIT License.

For contributions, bug reports, or feature requests, submit an issue on GitHub.